Organizing business receipts doesn’t have to be a chore. The secret is a simple, repeatable system that saves you hours and eliminates stress. Capture everything digitally, name it consistently, and file it into a logical folder. That’s it. This three-part habit is the key to transforming that dreaded shoebox of paper into a neat, searchable digital archive, giving you back your time and your peace of mind.

The Real Cost of That Shoebox Full of Receipts

That overflowing shoebox or messy desk drawer isn’t just clutter—it’s a hidden tax on your time, money, and sanity. Let’s be honest about the pain of disorganized receipts. The real cost isn’t the paper; it’s the lost hours and the creeping anxiety of knowing a financial mess is waiting for you.

Think about the last time you spent 30 minutes hunting down a single hardware store receipt from two months ago just to bill a client. Or that gut-wrenching feeling at tax time when you know you spent money on legitimate business expenses but can’t find the proof for hundreds of dollars in deductions. These are the moments that drain your productivity and steal time you could be using to grow your business or simply relax.

Hidden Costs of Manual Organization

The problems with manual receipt management run deeper than just a messy office. There’s the low-grade, constant stress of “what if I get audited?” which is surprisingly draining. This inefficiency also means you never really have a clear, up-to-the-minute financial picture of your business. To see just how much this adds up, you can read about the real cost of manual document filing and its impact on your bottom line.

This old-school approach creates some serious headaches:

- Wasted Productivity: Professionals can easily waste hours every week just looking for misplaced documents. Imagine what you could do with that time back. Instead of searching, you could be selling, creating, or strategizing.

- Missed Tax Deductions: If you can’t prove you bought it, you can’t claim it. It’s that simple. A lost receipt is literally lost money you’re handing over to the tax authorities.

- Increased Audit Risk: A jumbled, incomplete system is a huge red flag. If you are ever audited, not being able to quickly produce the right documents can lead to intense scrutiny and even penalties.

The goal isn’t just to get organized; it’s to build a system so simple and effective that it runs on autopilot, giving you back control, clarity, and peace of mind.

To really nail this down, it helps to see the big picture of how to track business expenses effectively . The core idea is to stop reacting to the mess and start proactively filing in a way that takes almost no effort.

Manual vs Digital Receipt Management at a Glance

Sometimes, seeing the difference laid out side-by-side makes it click. The “shoebox method” feels easy in the moment, but the long-term cost in time and stress is huge. A simple digital system requires a tiny bit of setup, but the payoff in productivity and calm is immediate and ongoing.

Here’s a quick breakdown:

| Aspect | The Old Way (Shoebox Method) | The Smart Way (Digital System) |

|---|---|---|

| Time Spent | Hours spent sorting, searching, and panicking during tax season. | Seconds to scan and file; seconds to find any receipt later. |

| Accuracy | High risk of lost receipts, faded ink, and missed deductions. | 100% digital record. No lost paper, no guesswork. |

| Accessibility | Stuck in one physical location. Need a receipt? Hope you’re at the office. | Accessible from anywhere, on any device. Instant retrieval. |

| Peace of Mind | Constant, low-level anxiety about audits and financial chaos. | Confidence knowing everything is organized, backed up, and audit-ready. |

The choice becomes pretty clear when you look at it this way. One path leads to more work and stress, while the other leads to efficiency and calm.

Create a Simple Digital Filing System That Works

Let’s be honest, organizing business receipts shouldn’t feel like a soul-crushing chore. The goal is to build a simple, repeatable workflow that gives you back your time and—more importantly—your sanity. Think of it as designing a digital command center that turns that pile of paper chaos into perfect clarity.

It all starts the second a receipt lands in your hand. Whether you’re grabbing coffee with a client or unboxing a new piece of equipment, the trick is to digitize it right then and there. A quick scan with your phone is all it takes to stop that paper from ever ending up in the dreaded shoebox. This one habit is the bedrock of a truly stress-free system.

If you’ve ever felt the pain of a disorganized shoebox system, this probably looks familiar. It’s a direct line from clutter to lost money.

This visual is a great reminder of the real cost of disorganization—it’s not just about the mess, it’s about wasted hours and missed tax deductions.

Establish a Consistent Naming Convention

Okay, so you’ve scanned the receipt. Now what? What you name that digital file is probably the most important part of this whole process. A generic name like “Scan_123.pdf” is completely useless six months from now when you’re frantically searching for it.

A consistent naming convention is your secret weapon. It makes every single file instantly searchable and is the cornerstone of how to organize business receipts properly.

I’ve found the most powerful format is YYYY-MM-DD_Vendor_Amount.

This simple structure does a few brilliant things. It automatically sorts your files by date, and a quick glance tells you everything you need to know about the expense.

For example:

- 2024-07-22_Staples_45.99.pdf (Office Supplies)

- 2024-07-20_Chevron_62.50.pdf (Vehicle Fuel)

- 2024-07-18_DeltaAirlines_349.00.pdf (Business Travel)

See? This tiny bit of effort upfront pays off in a huge way. Instead of digging through endless folders, you can use your computer’s search bar to find anything in seconds. Need all your fuel receipts from July? Just type “Chevron” or “2024-07” and you’re done.

Peace of mind comes from knowing exactly where everything is. A consistent file name is the first step toward building a system you can trust, eliminating the stress of searching for lost documents.

Design a Logical Folder Structure

With your files named like a pro, the last piece of the puzzle is giving them a logical place to live. I’ve seen people build folder systems so complex they need a map to navigate them. That’s not the goal. We’re aiming for simplicity and scalability—a structure that grows with your business without becoming a digital jungle.

The most effective approach I’ve used is a nested folder system organized by time and then by category. You can read more about creating a filing structure for small business that saves time and your sanity.

Here’s a dead-simple structure you can set up right now:

- First, create a master folder: Call it “Business Receipts.”

- Inside that, make folders for each year: “2024,” “2025,” etc. This is a non-negotiable for keeping tax years separate and clean.

- Within each year, create folders for your expense categories:

- Office Supplies

- Software & Subscriptions

- Travel & Meals

- Marketing & Advertising

- Utilities

This clear hierarchy makes filing a breeze. You just drag your perfectly named receipt into the correct folder. When tax season rolls around, you’re not scrambling—everything is already sorted and ready to go. You’ve just built a system you can actually stick with.

Sort Your Expenses for Smarter Business Decisions

Okay, so your receipts are scanned and have a consistent naming system. Now for the part that turns that digital pile of paper into a goldmine of business intelligence: categorization.

This isn’t just about keeping things neat. It’s about getting a perfectly clear picture of where every single dollar is going. That kind of clarity is the bedrock of smart financial management.

When you make this a habit, you stop guessing how much you spent on client lunches last quarter—you know the exact number. This is the kind of insight that lets you adjust budgets on the fly, catch overspending before it becomes a problem, and find new ways to save money.

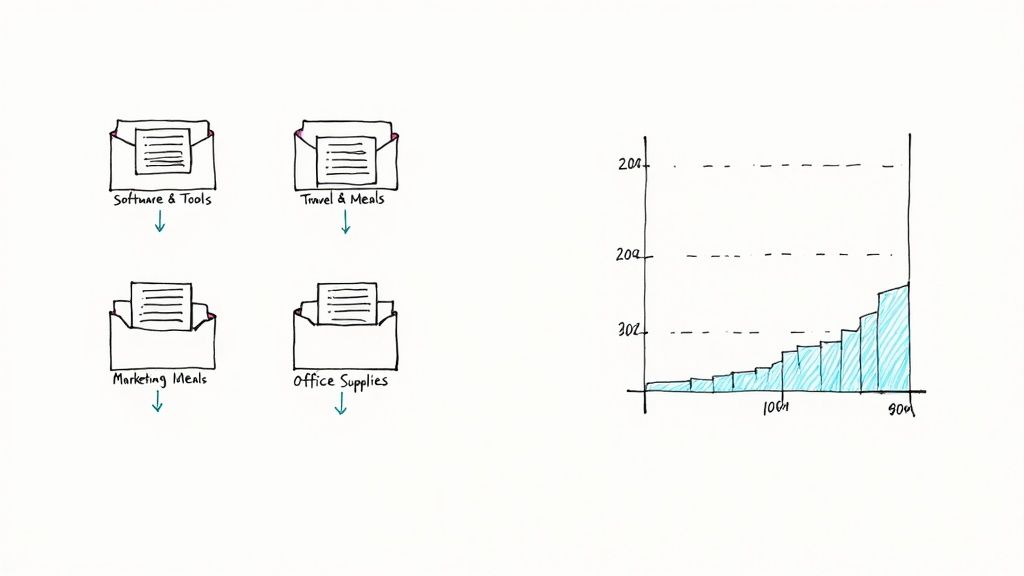

Common Business Expense Categories

The key is to create digital folders that mirror how you actually spend money. Don’t go overboard here. You want a system so simple you can use it on autopilot.

Most freelancers and small businesses can get by with just a few core categories. Here are some practical examples that work for almost everyone:

- Software & Subscriptions: This is for all those recurring fees. Think project management tools like Asana, your accounting software, or any other monthly or annual service.

- Office Supplies: Pretty straightforward. This covers printer paper, pens, notebooks—any physical items you need to keep the lights on.

- Marketing & Advertising: File your social media ad campaigns, email marketing service fees, and even the cost of printing business cards here.

- Travel & Meals: All your receipts for flights, hotels, client dinners, and coffees go in this bucket. It helps you see what you’re spending to get and keep business.

- Utilities: If you work from home, a portion of your internet and phone bills belongs here.

Taking this structured approach makes tax season a breeze. Instead of a mad dash to find everything at year-end, you have organized, categorized proof for every single deduction. Talk about peace of mind.

Sorting your expenses is like creating a financial map for your business. Each category is a landmark that shows you where you’ve been, helping you chart a smarter course forward.

Turning Data into Decisions

Once your expenses are neatly sorted, you can start asking the important questions. Are you spending more on software than you are on marketing? Is that travel budget actually bringing in a positive return? This is how you get ahead of your cash flow instead of just reacting to it.

For those ready to take it a step further, learning how to streamline your small business finances with QuickBooks and Airtable can be a game-changer.

When you connect your neatly organized receipts to your main accounting platform, you create a seamless flow of financial data. What started as a simple organizational chore becomes a real strategic advantage, saving you tons of time and ensuring your books are always accurate and ready for review.

Let Automation Handle Your Receipt Management

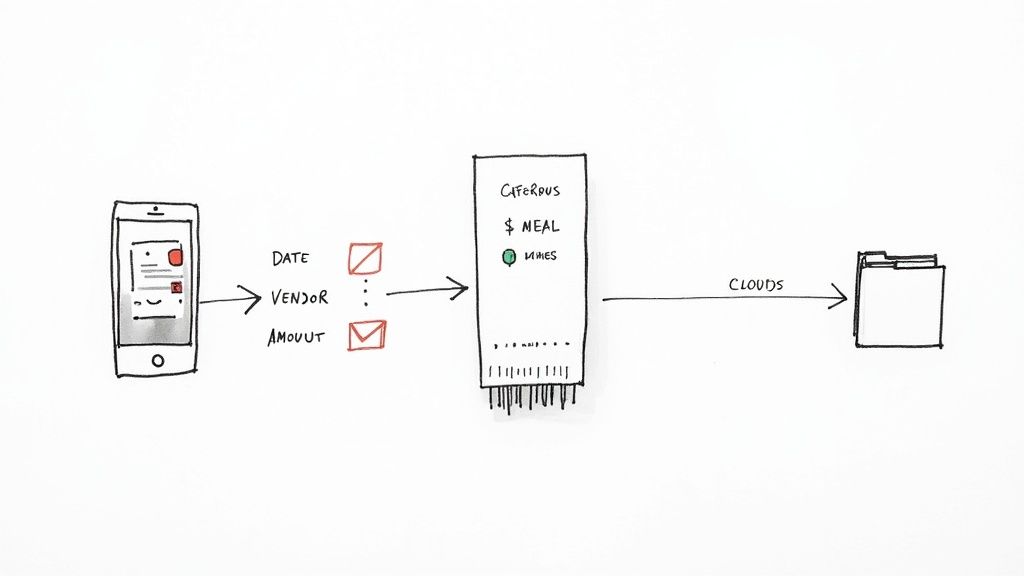

Setting up a digital filing system is a great start, but if you truly want to reclaim your time and achieve ultimate peace of mind, let’s talk about automation. This is where the real magic happens. Instead of you doing the work, AI and OCR (Optical Character Recognition) step in to do all the heavy lifting for you.

Imagine this: you snap a photo of a crumpled receipt. Instantly, an app reads the vendor, date, and amount, names the file perfectly, and files it into the correct folder. No typing, no dragging and dropping. The pain of manual filing is gone. This isn’t the future; it’s the new, smarter way to manage business receipts.

This move toward automation is more than just a convenience—it’s completely changing how businesses handle their finances. The demand for cloud-based receipt management is exploding, on track to become an $11.36 billion market by 2034. A huge chunk of that—37.4% to be exact—is just from receipt capture and scanning. It’s clear that businesses everywhere are ditching manual work for automated tools that offer better accuracy and save time.

How AI and OCR Give You Peace of Mind

At its heart, automation solves the two biggest pain points of managing receipts: human error and the sheer time it takes. Even with the best system, manually typing in data is a slow, tedious task where mistakes are inevitable. One tiny typo can throw off your entire budget.

AI-powered tools are the solution. Here’s a quick look at how they work:

- OCR Technology: This is the “eyes” of the operation. It scans an image of your receipt and turns all the printed text into digital data the computer can read.

- Artificial Intelligence (AI): This is the “brain.” It takes that raw data from the OCR, identifies what’s important (like the vendor, date, and total), and then uses that info to name and categorize the file for you automatically.

For instance, an AI tool like Fileo can look at a receipt from “The Home Depot,” instantly know it’s likely a “Business Supplies” expense, and file it in the right folder without you lifting a finger. If that sounds good, you should check out our guide on how to automate document filing .

Automation doesn’t just make you faster; it makes you more accurate. When you eliminate manual data entry, you build a financial record you can actually trust. That confidence is what gives you true peace of mind.

From Tedious Task to Effortless Habit

The real beauty of automation is how it turns a chore you dread into something that just happens in the background. Forget blocking out your Friday afternoons for bookkeeping. Now, you just capture receipts as you get them, and the system does the rest.

This frees up hours you can pour back into what really matters for your business—talking to customers, creating new products, or perfecting your services.

For a solo entrepreneur, that means more time for work that actually brings in money. For a growing team, it means your employees aren’t drowning in expense reports. This isn’t some far-off concept anymore; it’s a practical solution that makes organization effortless for everyone.

Make Your New System a Lasting Habit

Let’s be honest, a brilliant system for organizing business receipts is completely useless if you don’t actually use it. The real trick is weaving this new workflow into your daily routine until it becomes second nature—something you do without even thinking about it.

This isn’t about adding another draining chore to your list. It’s about integrating tiny, almost effortless actions that stop the mess before it starts. The goal is to just be organized, not constantly think about organizing.

Build Your Organizational Rhythm

When it comes to keeping your receipts in order for the long haul, consistency is everything. Instead of letting that pile of paper grow until it becomes a monster, find a rhythm that works for you.

Here are a few practical approaches I’ve seen work wonders:

- The Scan-As-You-Go Method: This is a lifesaver for productivity. The second a receipt is in your hand—at a client lunch, the gas station, wherever—scan it with your phone. It takes less than 30 seconds and guarantees that receipt won’t end up lost in a coat pocket or crumpled at the bottom of your bag.

- The Daily Batch Method: Prefer to wrap things up at the end of the day? Set aside just 5 minutes before you log off. Use that time to scan all the paper receipts you collected. It’s a quick and surprisingly satisfying way to close out your day with a clean desk.

- The “Finance Friday” Review: If you’re more of a weekly person, block out a recurring 15-minute slot on your calendar every Friday. Use this time to clear out your digital inbox, pay any bills, and make sure every file is in its proper home. This little habit prevents a massive weekend cleanup project from ever happening.

The best habit is the one you don’t have to think about. Try tacking your receipt scanning onto something you already do every day, like grabbing your morning coffee or shutting down your computer. It makes the whole process feel automatic.

Protect Your Digital Records

Once you’ve got your system running smoothly, the final piece of the puzzle is protecting all that hard work. Digital files are a world away from flimsy paper receipts, but you still need a couple of basic safeguards for total peace of mind.

Regular backups are absolutely non-negotiable. Most cloud storage services sync automatically, which is a fantastic start. But for an extra layer of security, I always recommend doing a secondary backup to an external hard drive or even a different cloud service at least once a month.

Finally, keep record retention rules in mind. The IRS generally says you need to hang onto business records for at least three years. However, most accountants (including mine) will tell you to play it safe and stick to a seven-year rule. A digital system makes this a breeze—your records won’t fade or get lost, ensuring you’re not just organized but also compliant and secure for years to come.

A Few Lingering Questions About Receipt Organization

Switching up how you handle your business receipts is a big step, and it’s totally normal to have a few questions pop up before you fully commit. Getting these last few details ironed out can be the difference between a system you actually stick with and one that falls apart in a month.

Let’s walk through some of the most common questions I hear. My goal is to give you the confidence to dive in, knowing your new process is solid.

How Long Do I Really Need to Keep Business Receipts?

This is the big one, right? The last thing anyone wants is to get into hot water with the IRS. Their official guidance says you need to keep records, including your receipts, for at least three years from the date you file your taxes. That’s the typical window for an audit.

But—and this is a big but—some situations can stretch that timeline out. That’s why the gold standard among bookkeepers and accountants is to hang onto everything for a rolling seven-year period. With a digital system, this is a piece of cake. Cloud storage is cheap, and you’ll never have to worry about a thermal paper receipt fading into oblivion.

Are Digital Copies of Receipts Legally Valid?

Yes, one hundred percent. The IRS has been accepting digital or scanned copies of receipts for years. The only requirement is that the copy is a clear, legible, and complete replica of the original paper version.

Once you have a good quality scan, you can toss the paper copy without a second thought. Honestly, digital is better anyway. Digital files don’t fade, you can search for them instantly, and they can be backed up in the cloud so you never lose them. Just make sure your scan is sharp enough to read all the key info: the vendor, date, amount, and what you bought.

The bottom line is this: a good digital copy is just as good as the paper original. You’re actually gaining security and accessibility, not losing it.

What’s the Best Way to Handle Cash Receipts?

Ah, cash receipts. These little guys need some extra attention. Unlike a credit card purchase that leaves a trail on your bank statement, a cash transaction is only documented by that little slip of paper. They’re so easy to misplace or just forget about entirely.

The trick is to deal with them on the spot.

- Make it a rule: “scan as you go.” The second that receipt hits your hand, pull out your phone and snap a picture of it with a scanning app.

- File it immediately. Don’t just let it sit in your camera roll. Use your naming convention (like YYYY-MM-DD_Vendor_Amount) and move it straight into the right folder.

This whole process takes less than a minute. It’s a tiny habit that saves you from the massive headache of trying to track down a lost receipt from a crumpled mess at the bottom of your bag. Mastering your cash receipts is a cornerstone of a truly organized system.

Ready to stop filing and start living? Fileo uses AI to automatically name, categorize, and organize your receipts and documents directly in your cloud storage. Reclaim your time and achieve effortless organization by visiting https://fileo.io to learn more.