To get a true handle on your business finances, you need a clear, consistent system. It’s all about sorting your costs into logical buckets—like marketing, utilities, and travel. When you use smart document management for this, that messy pile of receipts transforms from a source of stress into valuable financial data, giving you the clarity needed for tax prep and big-picture business decisions.

Why Smart Expense Categories Are a Game Changer

Let’s be honest, that growing stack of receipts isn’t just clutter. It’s a major pain point—a source of stress that pulls you away from what you should be doing: growing your business. The first step to transforming that chaos into clarity is a simple, smart categorization system. This isn’t just about getting through tax season without a headache; it’s about giving yourself a powerful tool for success, saving you time and delivering true peace of mind.

Imagine being able to make budget decisions with confidence, spot a money drain before it becomes a real problem, and actually forecast your cash flow. This isn’t some complex accounting wizardry. It’s about setting up a straightforward process that frees up your time and gives you the financial control to make smarter, faster moves. For a deep dive into trimming costs effectively, check out these high-leverage cost reduction strategies for 2025.

Beyond the Basics of Tax Prep

Of course, tax deductions are a huge win. But the real magic of good categorization is in the day-to-day insights it gives you. When you organize your expenses properly, your financial data stops being a history lesson and starts being a guide for the future. That’s where you find real peace of mind.

A well-oiled system brings a few key advantages:

- Clear Financial Visibility: You’ll know exactly where your money is going at a glance, letting you spot spending trends in an instant.

- Simplified Budgeting: You can create budgets and forecasts that are actually realistic because they’re based on accurate historical spending.

- Increased Productivity: Stop wasting hours digging through shoeboxes of receipts. Get back to the work that actually makes you money.

This clarity ripples through your entire business. For instance, data for 2025 shows that mileage, fuel, and equipment are consistently among the top five business expenses. By tracking these specific categories, you can uncover some major opportunities to save money.

From Manual Hassle to Automated Efficiency

We’ve all been there—the tedious, soul-crushing task of manually organizing documents. It’s a time-suck and a recipe for errors. This is a classic pain point for any business owner. Thankfully, AI-powered tools now provide a powerful solution by automating the whole process. Instead of typing in data by hand, you can let technology scan, read, and categorize your invoices and receipts for you.

A great system is the foundation. You can get started by exploring a filing structure for small business that saves time and boosts productivity.

The goal isn’t just to be organized. It’s to create a system so effortless that organization happens on its own. This frees up your mental energy to focus on strategy, growth, and the parts of your business you actually love.

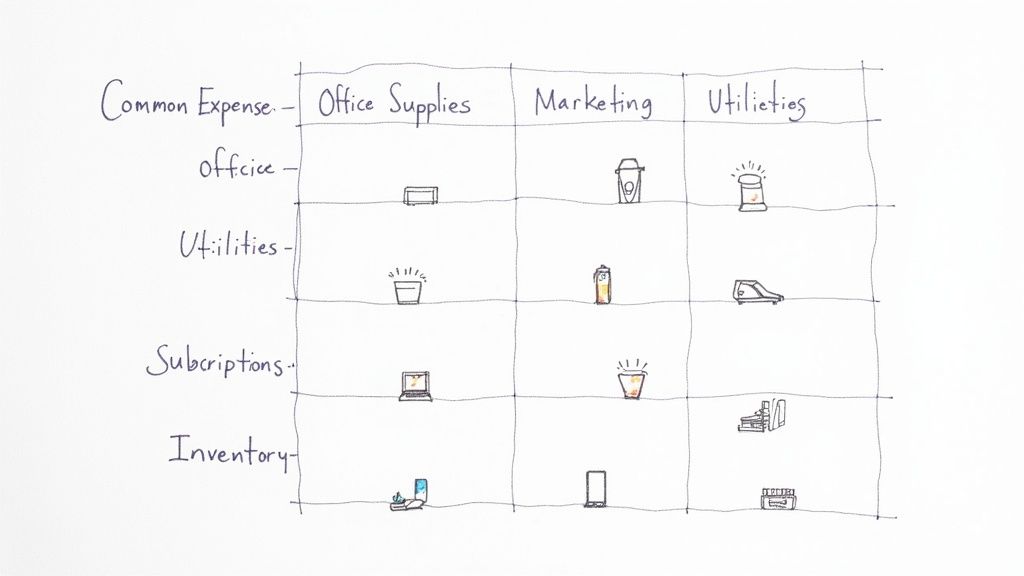

Your Starting Point: Common Expense Categories

Feeling swamped by a shoebox full of receipts? Don’t worry. The first step to getting organized is simply creating a few logical buckets to sort everything into. This isn’t about building a massive, accountant-level chart of accounts right now. It’s about setting up a practical system that makes sense for your business and takes the headache out of tax time.

We’ll begin with the core categories that almost every business has, then dive into how you can customize this list to fit exactly what you do. The whole point is to move from guessing to organizing with confidence.

Universal Categories Every Business Needs

No matter if you’re a freelance artist or you run a small manufacturing plant, some costs are just part of doing business. Think of these as your foundational categories—the non-negotiables that will show up month after month.

Here are the essentials pretty much everyone uses:

- Office Supplies: This is your catch-all for the day-to-day stuff that keeps things running, like pens, printer ink, notebooks, and even cleaning supplies for your workspace.

- Marketing & Advertising: Any cash you spend to get the word out belongs here. This includes everything from your Google Ads budget and social media campaigns to printing business cards or sponsoring a local event.

- Utilities: Your basic operating services. We’re talking internet, electricity, water, and your business phone line.

- Software & Subscriptions: This category has exploded in recent years. It covers all those recurring charges for tools like QuickBooks, project management apps, industry publications, and cloud storage.

- Professional Services: Did you hire an accountant to review your books or a lawyer to draft a contract? Their fees go right here.

The secret to making this work is to create categories that are broad enough for simplicity but specific enough to be useful. You don’t need a separate line for “Paper Clips” and another for “Staples.” Just group them under “Office Supplies” and save yourself the mental energy.

Customizing Categories for Your Business Model

Okay, now for the important part. A freelance writer’s expenses look nothing like a local coffee shop’s. Tailoring your categories to your specific business is what turns this from a simple bookkeeping chore into a powerful tool for understanding your profitability.

For a clearer picture, let’s look at how this plays out for two very different types of businesses.

Essential Expense Categories for Different Business Models

| Expense Category | Example for a Freelancer | Example for a Small Retail Business |

|---|---|---|

| Direct Costs | Software bought for a specific client project (e.g., a stock photo license). | Cost of Goods Sold (COGS): Coffee beans, milk, sugar, paper cups. |

| Workspace Costs | Home Office Expenses: A portion of rent, utilities, and internet. | Rent & Occupancy: Monthly lease for the storefront, property taxes. |

| Professional Growth | Professional Development: Online courses, industry conference tickets. | Staff Training: Barista certification courses, food safety training. |

| Asset Management | A new laptop or high-end ergonomic chair. | Equipment Maintenance: Espresso machine repairs, refrigeration servicing. |

By customizing your list, you get a crystal-clear view of where your money is really going. Are you spending too much on software you barely use? Is the cost of your raw materials creeping up? These are the kinds of insights that help you budget smarter and run a more efficient operation.

Unlocking Your Tax-Deductible Expenses

Alright, let’s get to the part where all this organizing actually saves you money. Understanding what you can write off on your taxes doesn’t have to be complicated. The real goal here is to trade tax-season anxiety for the confidence that comes from knowing your books are clean, organized, and ready for anything.

The golden rule from the tax authorities is pretty straightforward: a deductible expense must be both ordinary and necessary for your business. Think of it this way: an ordinary expense is something common in your line of work, and a necessary one is something that helps you do your job. That lunch where you landed a new client? That fits. Your daily latte on the way to the office? Not so much.

Drawing the Line Between Business and Personal

This is where things can get a little fuzzy, especially if you’re a freelancer or run your business from home. The secret to keeping it clear is simply to track everything diligently and document the “why” behind each expense.

Here are a few common situations where that line gets blurry:

- Vehicle Expenses: Using your car for work and personal errands? You can’t just deduct all your gas and maintenance. Instead, you need to track your business mileage. You can then write off either the standard mileage rate for those trips or the actual costs associated with them.

- Home Office: That home office deduction is great, but only if you have a specific area you use exclusively and regularly for your business. If you do, you can deduct a percentage of your rent, utilities, and insurance based on how much of your home’s square footage that office takes up.

- Client Meals: Taking a client out to eat to talk business is usually deductible, but often only up to 50%. The key is to make a note of who was there, what you discussed (the business purpose), and the date.

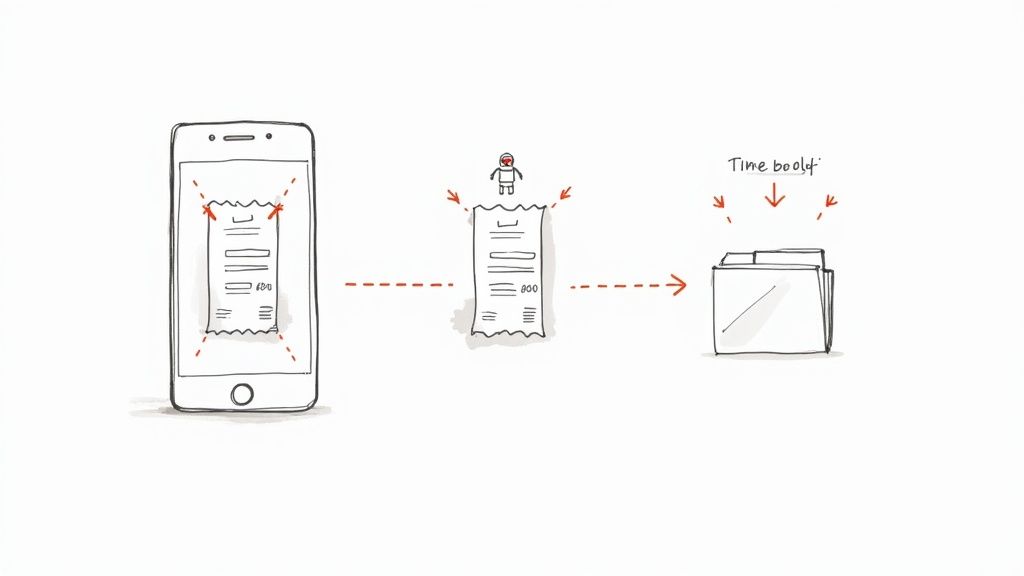

This simple workflow shows you how it all connects, from the moment you make a purchase to when you file.

Skipping any of these steps is risky. Without proof, even a perfectly legitimate expense can be thrown out in an audit. It really all comes down to building a consistent tracking habit.

Keeping Your Records Audit-Ready

Getting your categories right isn’t just for your own reports; it’s essential for staying on the right side of the tax office, especially when it comes to things like filing your GST/HST tax return. Good records are your best defense. Every single claim needs to be backed up by a receipt, invoice, or bank statement that clearly shows the amount, date, vendor, and business purpose.

Just look at the business travel industry. Spending is projected to hit $1.64 trillion by 2025, and you can bet every one of those dollars spent on flights and hotels will need proper documentation for both tax deductions and internal budgets.

Peace of mind isn’t about being a tax expert. It’s about having a simple, reliable system for documenting your expenses as they happen, so you never have to second-guess your deductions.

When you take this approach, tax season stops being a frantic scramble and becomes just another straightforward financial check-in.

Building a Simple Expense Workflow That Sticks

You can have the most perfect expense categorization system in the world, but it’s completely useless if it’s too complicated to actually use. The real key to getting your time back and ditching the financial stress isn’t some ridiculously complex spreadsheet. It’s all about creating a simple, low-effort routine you can stick with day in and day out.

Let’s forget about that month-end panic. The goal here is to weave expense tracking into your regular workweek so it becomes a quick, second-nature task, not a chore you dread. This isn’t about adding more to your to-do list; it’s about breaking down a huge job into tiny, manageable steps that stop the paper pile-up before it even starts.

The Daily 60-Second Receipt Ritual

We’ve all been there. A mountain of crumpled, fading paper receipts. They get lost, they create clutter, and they’re a pain to sort through. The fix is surprisingly simple: deal with them the second you get them.

Try building this simple daily habit:

- Snap a Photo Immediately: Before that receipt even makes it into your wallet or pocket, take 60 seconds to snap a clear picture of it with your phone.

- Send It to Its Home: Immediately upload that photo to your document management app (like Fileo) or a specific folder in your cloud storage.

- Toss the Paper: Once you’ve got the digital copy safely stored, you can throw the physical receipt away. Clutter, gone.

This tiny ritual takes less than a minute but it will save you hours of digging through shoeboxes and junk drawers later on.

Your Weekly 15-Minute Financial Check-In

For all the digital stuff—email invoices, bank transactions—a quick weekly review is all it takes to stay on top of your finances. I recommend blocking out just 15 minutes every Friday afternoon. This short, focused session is your secret weapon against a month-end pile-up.

A simple, consistent routine is far more powerful than a frantic, once-a-month cleanup. By investing just a few minutes each day and week, you build momentum and turn a stressful task into an effortless habit.

Use this time to categorize any digital invoices that have landed in your inbox. It’s also the perfect time to give your business bank and credit card statements a quick scan for any transactions that haven’t been assigned a category yet.

As you get into this groove, you’ll start seeing opportunities to make things even easier. This is when you can explore how to automate document filing and reclaim your time, which cuts out even more of the manual work. By creating these simple workflows, knowing how to categorize business expenses becomes just another productive, stress-free part of running your business.

Putting Your Expense Organization on Autopilot

If you’re tired of manual data entry, it’s time to let technology take over. Modern tools can completely change how you handle business expenses, turning a tedious chore into a background task that just gets done. This shift doesn’t just save a ton of time; it also makes your records far more accurate, freeing you up to focus on what actually grows your business.

Imagine this: you buy some office supplies, snap a quick photo of the receipt, and it’s instantly and correctly logged under your ‘Office Supplies’ category. No typing needed. That’s the real power here. It’s the end of digging through your wallet for faded receipts and the soul-crushing task of entering every single transaction by hand. You get hours of your week back and some priceless peace of mind.

This is exactly how it works in practice. An AI-powered tool can scan a document, like a receipt, and pull out all the key information for you.

The system is smart enough to identify the vendor, date, and total amount, getting it ready for automatic categorization. This all but eliminates human error and makes your financial records incredibly reliable.

How AI-Powered Tools Make This Possible

Let’s be honest, the pain of manual organization is real. It’s slow, full of potential mistakes, and just plain draining. Every minute you spend typing in receipt details is a minute you aren’t spending with a client or planning your next big move.

Here’s a look at how these tools do the heavy lifting:

- Optical Character Recognition (OCR): First, the AI scans the receipt or invoice and “reads” the text, much like your own eyes would. It picks out the vendor, date, total, and even individual line items.

- Intelligent Data Extraction: It doesn’t just see the text; it understands it. The tool knows “Staples” is a vendor and that the number next to “Total” is the amount to record.

- Automated Categorization Rules: This is where the magic happens. Based on the vendor or keywords it finds, the system automatically assigns the expense to the right category. For instance, you can teach it that any charge from “GoDaddy” should always be filed under ‘Website Expenses’.

The biggest win with automation isn’t just speed—it’s consistency. A good system applies your rules the same way, every single time. That means you get clean, reliable financial data you can actually trust for budgeting and tax planning.

This approach is quickly becoming the norm. In fact, by 2025, a staggering 87% of CFOs plan to invest in expense automation to get their accuracy and compliance in order. They’re using smart tagging and custom rules to classify transactions, which drastically cuts down on manual work and prevents costly mistakes.

Choosing the Right Automation Tool

With so many options out there, picking the right tool can feel a bit overwhelming. The key is to find something that fits into your current workflow without making things more complicated. A good tool should feel intuitive from the start.

If you want to see what’s out there, this guide on the top 12 best receipt organizer app solutions for 2025 is a great place to start your search.

Ultimately, setting your expense organization on autopilot is one of the smartest moves you can make for your productivity. You’ll swap a draining manual process for an efficient, reliable system, giving you cleaner books and more time to invest in what you do best.

Even with the best system in place, questions are going to pop up. That’s perfectly normal. Getting a handle on these common sticking points is what helps you build confidence and keep your financial records clean.

Let’s walk through a few of the questions I hear most often from business owners.

How Many Expense Categories Do I Really Need?

There’s no magic number, but most small businesses land somewhere in the 20 to 30 category range. That seems to be the sweet spot.

The goal is to get enough detail to make smart decisions, but not so much that you’re drowning in options every time you log a receipt. Start broad with things like “Marketing” or “Office Supplies.” You only need to break it down further—say, into “Social Media Ads”—if you actually plan to analyze that specific spending. If you’re not sure where to begin, the default chart of accounts in your bookkeeping software is a fantastic starting point.

What’s the Difference Between an “Expense” and “Cost of Goods Sold”?

This one is huge, and getting it right is fundamental to understanding your real profitability.

- Cost of Goods Sold (COGS): These are the direct costs of making what you sell. If you run a coffee shop, this is your coffee beans, milk, and paper cups.

- Operating Expense: This is everything else you spend just to keep the business running. For that same coffee shop, it’s the rent, your payroll, and the subscription for your payment processor.

Keeping these separate is non-negotiable. It tells you two different stories: what it costs to produce your product versus what it costs to just open your doors every day. That clarity is a game-changer for understanding your financial health.

Here’s a simple way to think about it: COGS are the ingredients in the recipe. Operating expenses are the kitchen, the chef’s salary, and the marketing to sell the final dish. Both are essential, but they serve very different purposes on your financial statements.

Can I Change My Expense Categories Later On?

Of course! Your business evolves, and your expense categories should, too. In fact, they have to.

I always recommend clients review their categories at least once a year. As you grow, you might realize you suddenly need a dedicated “Software Subscriptions” category, or maybe you can merge a few smaller ones that you barely use.

The only real rule here is to be consistent throughout a single tax year. Don’t go changing things mid-stream in June. This keeps your annual reports clean and easy for you—and your accountant—to make sense of. A thoughtful annual review ensures your financial system grows right alongside your business.

Tired of manually sorting stacks of receipts and invoices? Fileo can put your document management and expense sorting on autopilot. Our AI-powered tool reads and categorizes your business expenses for you, saving you hours of tedious work and giving you perfectly organized financials. Learn how Fileo can transform your workflow today.