If you’ve ever spent an afternoon punching invoice details into a spreadsheet, you know the frustration of manual data entry. Late fees sneak in, approvals get stuck in email limbo, and the constant fear of a typo drains your team’s energy. It’s a slow, stressful process that quietly chips away at your bottom line and your peace of mind.

Imagine a growing business drowning in a mountain of paper invoices. Every single one is a landmine of potential pain points: tedious data entry, endless proofreading, and a frustrating chase for sign-offs. This manual chaos doesn’t just slow things down; it creates stress and opens the door to costly mistakes.

The Pain Points of Manual Invoice Entry

- Late Payment Penalties when approvals get buried in overflowing inboxes.

- Wasted Hours from manually correcting typos and chasing missing information.

- Duplicate Payments caused by simple human error and disorganized files.

- Lost Discounts because the slow approval process makes it impossible to pay early.

The Daily Grind That Drains Productivity

Switching between emails, PDFs, and accounting software is a recipe for distraction. Think of it as a carousel of busywork you can’t get off. Every interruption steals focus, pulling your team away from valuable tasks like analyzing spending or negotiating better terms with vendors. This constant shuffle is a major source of stress and inefficiency.

Finance teams report spending over 30% of their time on this kind of invoice-related busywork.

- Manually typing data from PDF invoices.

- Chasing managers for approvals via email and Slack.

- Cross-checking numbers between different, disconnected systems.

- Physically filing, finding, and refiling paper documents.

The Real Cost to Your Business

Late approvals don’t just trigger penalties; they can damage your relationships with trusted vendors. A few small late fees might seem minor, but they add up, representing money that could have been invested back into your business.

This administrative drag also turns month-end closing into a frantic scramble, leaving everyone stressed and exhausted. Instead of feeling in control, your team is just trying to keep up.

Learn more about the true expense of manual document filing in our article.

Switching to automated invoice processing software is the solution that brings calm to this chaos. By letting AI handle the data capture and approvals, you give your team the gift of time—time they can use for strategic work that actually moves the needle.

AI Solutions for Peace of Mind

- Set Clear Approval Rules: Define who approves what, based on department or amount, and let the software handle the routing.

- Automate Data Capture: Use OCR to instantly digitize invoices the moment they arrive. No more typing.

- Flag Exceptions Automatically: Create workflows that catch anomalies, like a sudden price increase, so you only review what matters.

- Integrate Your Systems: Connect the software to your accounting system for a seamless flow of accurate data.

- Run a Small Pilot: Test the system with a handful of real invoices to build confidence and train the AI.

These simple, actionable steps can slash your processing time by over 50%, turning a multi-day headache into a task that takes just a few hours.

- Start with a small, familiar batch of invoices.

- Feed the system vendor templates to speed up recognition.

- Set up automatic alerts for approvals to prevent bottlenecks.

“After automating invoices, our team saved over 50 hours each month and eliminated errors,” says the finance manager at a growing tech startup. “The peace of mind is priceless.”

By identifying these pain points and using AI-driven workflows, you set your finance team up for faster closes and calmer, more productive days. Next, we’ll dive into how this all works.

How Invoice Automation Software Actually Works

Think of automated invoice processing software as the smartest, most efficient member of your finance team—one that works 24/7 without needing a coffee break. It takes that mountain of paper or inbox full of PDFs and transforms it into clean, organized digital data, all without someone having to key in a single number.

The magic starts the moment an invoice arrives. The software’s “eyes” are a technology called Optical Character Recognition (OCR). It’s a fancy term for a simple job: OCR scans paper or digital invoices and instantly converts all the text into machine-readable data.

It’s like taking a high-speed photo of a document and having a program instantly type every word, number, and date into a spreadsheet. This simple step alone slashes data entry errors before the “brain” of the system even gets involved.

Optical Character Recognition Explained

So, how does OCR do it? It uses sophisticated pattern matching to recognize different characters, fonts, and even the unique layouts of invoices from hundreds of different vendors. It’s smart enough to tell a due date from an invoice number, no matter where it is on the page.

Essentially, the process breaks down like this:

- The software captures an image of the invoice, whether it’s a scanned document, a PDF, or even a photo from a phone.

- It then intelligently separates the document into logical blocks—vendor details here, line items there, and the grand total down at the bottom.

- Finally, it converts that visual information into structured data that your accounting systems can understand.

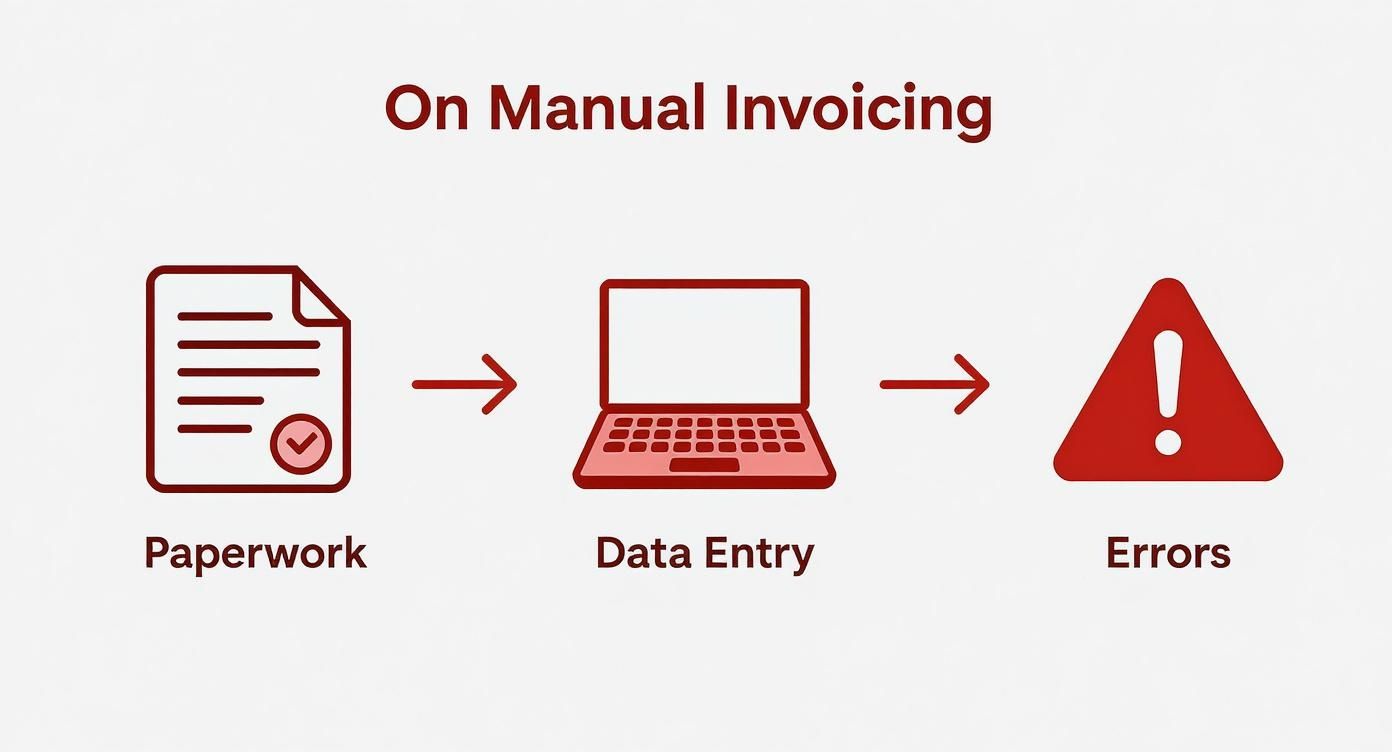

The infographic below really paints a picture of the old-school manual process. The red areas highlight all the pain points we’ve all felt.

You can see how easily those stacks of paper lead to tedious data entry, which is where costly mistakes creep in at every single step.

How AI and Machine Learning Become the Brain

Once OCR has done its job digitizing the invoice, the system’s “brain”—artificial intelligence (AI) and machine learning—kicks in. This is where the real intelligence happens. These algorithms have been trained to understand the context of an invoice and pull out the most important information with incredible precision.

The AI zeroes in on key details like vendor names, invoice numbers, due dates, and total amounts. But it doesn’t just stop there. It cross-references this data with your purchase orders, contracts, and vendor records to make sure everything lines up perfectly.

It’s constantly checking for things like:

- Making sure the invoice total matches the approved purchase order amount.

- Flagging any weird anomalies, like a sudden price jump or a duplicate invoice number.

For a deeper dive into how OCR gets data ready for this step, check out our guide on how an OCR document organizer works. This validation step is crucial; the software automatically verifies everything it can and only bothers your team when a human needs to look at a genuine exception.

Thanks to continuous learning and advanced language processing, modern systems often achieve accuracy rates that exceed 90%.

From Validation to Approval

Once an invoice is validated, it doesn’t just sit in a digital pile. It gets automatically sent along a custom approval workflow. Your finance team can set up the rules ahead of time—maybe invoices under $500 from a certain vendor go straight to payment, while anything over $10,000 needs approval from a department head.

Here’s a quick look at the journey an invoice takes:

- An OCR agent scans and digitizes the invoice.

- AI extracts and validates all the key information.

- The system matches the invoice against purchase orders or contracts.

- It’s automatically routed to the correct approver based on your rules.

- Once approved, the invoice is archived in a secure, searchable digital folder.

From there, the system can even connect to your payment platforms to close the loop. An efficient process isn’t just about approvals; it’s about getting suppliers paid on time, which is where supplier payment automation comes in.

This end-to-end approach typically results in 60% faster processing times and up to 40% fewer human errors.

Believe it or not, only about 8% of finance teams around the world are fully automated. A surprising 60%-64% still lean heavily on manual methods, which shows just how much opportunity there is for improvement.

When you consider that processing a single invoice manually costs an average of $22.75, the savings start to add up fast. AI-powered systems don’t just reduce that cost; they cut processing time by over 60%, slash errors by 40%, and make it much easier to spot potential fraud.

Benefits You Can Expect

Bringing invoice automation into your workflow isn’t just about new technology; it’s about getting real, measurable results. Teams often find they get back dozens of hours every month and practically eliminate late payment penalties.

Here are a few of the biggest wins:

- A dramatic drop in time spent on manual data entry.

- Effortless audit readiness with a clean, digital paper trail.

- Fewer late fees and happier vendors thanks to faster approvals.

Ultimately, these benefits give finance teams more time to focus on strategic work instead of chasing paperwork. Managers get clear visibility into spending, approval bottlenecks disappear, and the entire accounts payable process runs smoothly. It’s a clear win-win.

Key Features That Drive Business Efficiency

Not all invoice processing software is created equal. To really reclaim your team’s time, get more done, and finally feel in control of your finances, you need a system with a few specific, non-negotiable capabilities. These are the features that transform a chaotic paper chase into a smooth, predictable operation.

Let’s break down what these core functions actually do and how they solve the everyday headaches that plague accounts payable teams.

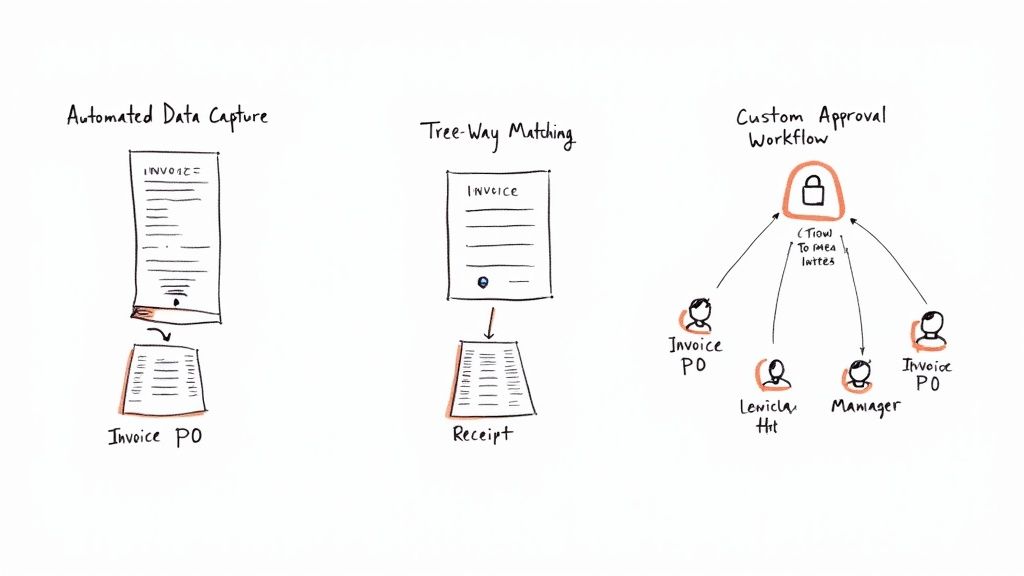

Automated Data Capture Ends Manual Entry for Good

Let’s be honest: the most soul-crushing part of invoice processing is typing everything in by hand. It’s tedious, a breeding ground for typos, and eats up countless hours every week. Automated data capture is the feature that makes this pain go away permanently.

Using a technology called Optical Character Recognition (OCR), the software “reads” and pulls all the important information from an invoice—whether it’s a PDF, a scanned paper copy, or even a photo from a smartphone.

- The Painful Past: An AP clerk spends their day keying in vendor names, invoice numbers, and line items. One wrong digit leads to an overpayment, kicking off a frustrating chain of emails to fix the mistake.

- The Productive Present: Invoices are automatically uploaded and digitized in seconds. The software grabs the data with incredible accuracy, freeing up your team to handle important exceptions instead of mind-numbing data entry.

Three-Way Matching Is Your Built-In Fraud Prevention

How do you know you’re only paying for what you actually ordered and received? The answer is three-way matching. Think of this feature as your automated financial security guard, making sure every single payment is legitimate.

It works by instantly cross-referencing three crucial documents: the purchase order (PO), the goods receipt, and the vendor’s invoice. If the details—like quantities, prices, and item descriptions—don’t line up perfectly across all three, the system flags it for a human to review.

This one feature is a game-changer for reducing the risk of duplicate payments, outright fraud, and paying for incorrect shipments. It delivers some serious peace of mind.

For example, imagine a vendor accidentally bills you for 100 items, but your warehouse team only signed for 95. Three-way matching catches that mismatch immediately. Without it, you might not spot the error until a manual audit weeks or months later, long after you’ve already paid the wrong amount.

Customizable Approval Workflows Eliminate Bottlenecks

One of the top reasons for late payment fees is an invoice getting lost in someone’s inbox, waiting for approval. Customizable approval workflows put an end to these delays by automatically sending invoices to the right person based on rules you set up yourself.

No more manually forwarding emails or physically chasing down managers for a signature. You can build logic that’s as simple or as complex as your business needs.

Here’s a practical example:

- Invoices under $500 from a regular supplier can be set to approve and pay automatically, saving everyone time.

- An invoice for marketing services between $501 and $5,000 gets routed directly to the Marketing Director for a quick review.

- Any invoice over $10,000 might require two-step approval from both the department head and the CFO, ensuring proper oversight.

This keeps everything moving, ensures payments go out on time, and helps you maintain great relationships with your vendors.

Seamless Integration and Real-Time Dashboards

Your invoice automation tool shouldn’t live on an island. To get the most out of it, it needs to connect seamlessly with the accounting software or ERP system you already use, whether that’s QuickBooks , Xero , or NetSuite .

This connection means that once an invoice is approved, all the data syncs directly to your general ledger. This completely removes double data entry, keeps your financial records accurate, and gives everyone a single source of truth to work from.

On top of that, the best platforms provide real-time analytics dashboards. These give you a bird’s-eye view of your entire AP world at a glance.

You can instantly see things like:

- Total pending payments and what they mean for your cash flow.

- Where any invoice is in the approval process.

- Your average invoice processing time and where things might be getting stuck.

- Opportunities to grab early payment discounts.

This kind of visibility helps you make smarter financial decisions, turning your AP team from a reactive cost center into a strategic part of the business. When you pick a solution with these core features, you’re not just buying software—you’re investing in a more productive, secure, and stress-free financial future.

What Are the Real-World Benefits of Automating Invoices?

It’s easy to get lost in the technical features, but the real magic of automated invoice processing is how it changes your day-to-day. It’s about swapping the stress of tedious, manual work for smooth efficiency and a genuine sense of control. The benefits really come down to three things every business owner or manager craves: a more productive team, massive time savings, and some well-deserved peace of mind.

Unlock Your Team’s True Potential

Let’s be honest: manual invoicing turns your skilled accounts payable team into data entry clerks. Their days are consumed by keying in details, chasing down approvals, and fixing typos—hardly the strategic work they were hired for.

Automation completely flips that script.

By taking the repetitive drudgery off their plates, the software frees up your team to focus on what actually matters. Instead of just pushing paper, they can analyze spending trends, negotiate better deals with vendors, and actively manage cash flow. This shift transforms your AP department from a reactive cost center into a proactive, strategic asset.

The explosive growth in this space tells the whole story. The global invoice processing software market is on track to hit around USD 36.1 billion in 2025 and is expected to rocket to USD 189.2 billion by 2035. This isn’t just hype; it’s a direct response to a universal need for less human error and better efficiency. You can see the market growth breakdown for yourself.

Get Your Most Valuable Asset Back: Time

The first thing you’ll notice after switching is just how much time you get back. What used to be a week-long marathon of shuffling papers, sending endless follow-up emails, and juggling spreadsheets can shrink to just a few hours.

A process that once dragged on for days can now be wrapped up in a single afternoon. This is a game-changer for month-end closing, turning a frantic scramble into a smooth, predictable routine.

Think about a small business getting dozens of invoices a week. Their AP manager used to burn nearly two full days every month just getting everything paid, often missing out on early payment discounts in the process. After implementing an automated system, they cut that processing time by over 80%.

- Invoices are captured and coded the moment they arrive.

- Approvals are automatically routed and handled within hours.

- Payments are scheduled on time, every single time.

This newfound efficiency didn’t just eliminate a major headache. It also allowed them to capture a 2% early payment discount from their key suppliers, adding thousands of dollars straight back to their bottom line each year.

Finally Achieve Peace of Mind

Last but not least, let’s talk about the incredible feeling of being in control. Manual processes are full of risks. A simple typo can lead to a huge overpayment, a lost invoice can sour a great vendor relationship, and a messy filing cabinet can make an audit an absolute nightmare.

Automated systems bring calm to that chaos. They slash human error, ensuring accuracy from the second an invoice hits your inbox. With a central, searchable digital archive, every invoice—along with its approval history—is stored securely and can be pulled up in seconds. This creates a rock-solid, audit-ready trail that makes compliance a breeze.

That peace of mind extends to your financial security, too. The software acts as a guard dog, flagging duplicate invoices and enforcing your approval rules to help prevent both internal and external fraud. You can finally relax, knowing every payment is verified, approved, and correctly recorded. That’s what true confidence in your financial operations feels like.

How to Choose the Right Automation Software

Picking the right automated invoice processing software isn’t about finding a mythical, one-size-fits-all solution. It’s about finding the perfect fit for your business. Get it right, and you’ll boost productivity, save countless hours, and gain some much-needed peace of mind. Get it wrong, and you might just create more headaches than you solve.

Before you even start looking at vendors, take a hard look at your own process. How many invoices are you really dealing with each month? Are your biggest bottlenecks slow approvals, manual data entry errors, or just not knowing where your money is going? Answering these questions first gives you a clear roadmap of what problems you actually need the software to fix.

Look Beyond the Price Tag

Of course, cost matters. But the real value of any tool is in what it can do for you and how easy it is for your team to use. A powerful system with a clunky interface will just gather digital dust. You need to find a solution that blends robust features with a great user experience.

When you’re comparing your options, zero in on these critical elements:

- Ease of Use: Is the interface intuitive, or does it feel like you need a pilot’s license to operate it? A complicated system will kill adoption rates and frustrate your team, completely defeating the purpose of automation.

- Integration Capabilities: Does it play well with the tools you already use, like your accounting software? Seamless integration with systems like QuickBooks or Xero is a must-have to finally kill off double data entry.

- Scalability: Can this software grow with you? You want a solution that can handle a big jump in invoice volume down the road without forcing you to start this whole search over again.

- Customer Support: What happens when you hit a snag? A responsive and knowledgeable support team can turn a major roadblock into a minor hiccup.

Security and Compliance Are Deal-Breakers

You’re trusting this software with sensitive financial data, so security can’t be an afterthought. A vendor’s approach to security should align with the principles of a comprehensive Information Security Management System (ISMS) . This is a good sign that they’re serious about everything from data encryption to secure access controls.

The demand for this kind of efficiency and control is exploding. The global automated invoice processing software market is expected to hit around USD 832.7 million by 2025. This growth is largely fueled by businesses moving toward cloud-based tools that are both scalable and easy to access.

A vendor’s commitment to security is a direct reflection of their commitment to your business’s financial health. Don’t be afraid to ask tough questions about their security protocols and compliance certifications.

Your Demo Checklist: Questions to Ask

A product demo is your golden opportunity to see the software in action and get straight answers. Don’t let them give you a generic slideshow. Come prepared with questions that get to the heart of your specific challenges.

Bring this checklist to your next demo:

- Can you walk me through processing a real invoice from one of our top vendors?

- What does the approval workflow look like if it needs to go through three different people?

- How does the system catch a duplicate invoice or a PO mismatch?

- What kind of training and onboarding do you offer to get our team up and running?

- Show me exactly how to export data into our specific accounting system.

Finding a partner who can answer these questions with confidence is the first step toward a solution that actually delivers on the promise of automation.

Making a Smooth Transition to Automation

Bringing new technology into your business should be exciting, not a headache. The key to a successful rollout is to take it one step at a time, building confidence and making sure your team’s daily work isn’t thrown into chaos.

Start with your people. Walk them through the benefits—less mind-numbing data entry, fewer mistakes, and more time to focus on work that actually matters. When your team understands why you’re making a change and how it will improve their day, they’ll get on board much faster.

Your Step-by-Step Implementation Guide

The best way to tackle this is to break the process down into smaller, manageable chunks. Think evolution, not revolution. A phased approach gives everyone a chance to get comfortable without the pressure of a sudden, company-wide switch.

A great place to begin is by testing the automated invoice processing software with a small batch of real invoices. Pick a few vendors you work with all the time, whose invoice formats are familiar. This pilot run lets you iron out any wrinkles and teach the AI what your documents look like, all without putting your entire accounts payable process on the line.

A smart tactic is to run the new system in parallel with your old one for a short while. This lets you compare the results side-by-side, giving you a safety net and concrete proof of the software’s accuracy before you go all in.

Configuring Your System for Success

Once you’re confident that the software is capturing data correctly, it’s time to build your approval rules. This is where you essentially teach the system your company’s internal policies so it can handle the routing for you.

Here are a few tips to make the setup a breeze:

- Start Simple: Don’t try to boil the ocean. Begin with basic rules, like automatically approving any invoice under $100 or sending all IT invoices directly to the head of the tech department.

- Involve Your Team: Get your department managers involved. Ask them for their approval limits and who needs to sign off on what. This ensures the digital workflows match how your business actually runs.

- Test and Refine: Before going live, send a few test invoices through your new workflows. It’s a simple check to make sure they land on the right desks.

This careful, step-by-step approach is your ticket to a flawless transition. For more ideas on getting your digital house in order, you can automate document filing and reclaim your time with our other guide. By managing the implementation thoughtfully, you’ll set your team up to enjoy all the rewards of automation—more productivity, massive time savings, and a lot less stress.

Common Questions About Invoice Automation

Thinking about switching to automated invoice processing software can feel like a big leap. It’s normal to have a ton of questions before you dive in. To help you get a clearer picture, we’ve put together some of the most common ones we hear from business owners and finance teams.

Let’s cut through the jargon and get straight to the practical answers on cost, security, and how this technology really works day-to-day.

Is This Software Only for Big Companies?

Not at all. That’s probably the biggest misconception out there. Today’s cloud-based tools are built to be affordable and to grow with you, which makes them a fantastic fit for small and mid-sized businesses.

Here’s a good rule of thumb: if your team is manually handling more than 50 invoices a month, you’re almost guaranteed to see a quick and meaningful return on your investment from the time saved and errors avoided. You don’t need a huge AP department to get huge benefits.

How Accurate Is the Data Extraction?

It’s impressively accurate. The leading platforms use a combination of Optical Character Recognition (OCR) and AI to hit accuracy rates that are often above 95%. The technology doesn’t just scan the words; it actually understands the context, so it knows the difference between an invoice number and a PO number.

The real magic is that the system learns on the job. The more invoices it sees from a particular vendor, the smarter its AI gets at recognizing their specific layouts. It continuously improves with every document processed.

This learning ability means fewer and fewer exceptions for your team to fix over time. They can spend their energy on more important work instead of getting bogged down in data entry corrections.

Will It Work With My Accounting System?

Yes, this is a must-have feature for any good platform. Most invoice automation tools are designed to connect smoothly with popular accounting software like QuickBooks , Xero , and Sage, as well as larger ERP systems.

This direct link means once an invoice is approved, all the data flows right into your general ledger automatically. No more mind-numbing double data entry, and your financial records stay perfectly in sync.

How Secure Is My Financial Data?

Top-tier providers take security extremely seriously. They use enterprise-level security to protect your sensitive information, which includes encrypting your data both when it’s being sent and when it’s being stored. They also perform regular security audits and keep your data in highly secure data centers.

For many small businesses, this is a much higher level of security than they could manage on their own. It gives you real peace of mind to know your financial data is in expert hands.

Ready to stop chasing paperwork and start reclaiming your time? Fileo uses AI to automatically organize your invoices and other critical documents right within your cloud storage. See how much time you can save .