A good filing structure for your small business is about so much more than just having neat folders. It’s a system built for pure productivity and peace of mind. The most practical way to tackle it is by organizing your documents into broad business categories—think Finance, Clients, and Admin—and then using a consistent, logical naming system that makes every single file easy to find in seconds.

Stop Searching and Start Working

Lost documents and messy folders aren’t just a minor annoyance; they actively drain time, money, and focus from your business. We’ve all been there—frantically searching for that one specific invoice right before a client call or feeling that rising panic during tax season because receipts are scattered everywhere. This digital clutter is a silent productivity killer, the kind of manual work that holds you back.

A smart filing structure for small business isn’t just about tidying up. It’s a foundational strategy to boost your efficiency and give you some much-needed peace of mind. An AI-powered system can automate this entire process, turning a digital junk drawer into a streamlined powerhouse and setting you up for a complete organizational makeover.

The Real Cost of Digital Disorganization

Every moment you spend hunting for a file is a moment you’re not spending on what really matters: growing your business. This disorganization creates hidden costs that pile up fast, hitting everything from your bottom line to your mental well-being.

When your system is a mess, you’ll feel the consequences:

- Wasted Time: Hours get eaten up searching for files that could have been spent on revenue-generating tasks. If this sounds familiar, it’s worth learning how to save time organizing files to reclaim your day.

- Increased Stress: There’s a constant, low-level anxiety that comes from not knowing where critical documents are when you need them.

- Missed Opportunities: You can’t act quickly on proposals, client requests, or big decisions if you can’t find the information you need.

- Compliance Risks: Finding legal, financial, or tax documents becomes a nightmare, especially when you’re on a deadline.

To really see the impact, think about how efficient record-keeping affects your finances. Learning how bookkeeping helps your business save time and money can show you the direct benefits.

A Growing Need for Smart Systems

The entrepreneurial world is on fire. According to the U.S. Census Bureau, monthly business applications are now over 435% higher than they were just two decades ago. That’s a massive surge in new ventures.

Even better, this growth is happening alongside a nearly 74% drop in business bankruptcies since 2004. This tells us we have a more stable and confident small business sector that needs solid systems to keep thriving.

This new wave of entrepreneurs needs systems that can grow with them. A messy filing system that you could get by with as a solo operator becomes a major roadblock the moment you hire your first employee. This guide is your blueprint for building an organized, stress-free digital workspace from the ground up, with actionable steps you can take today.

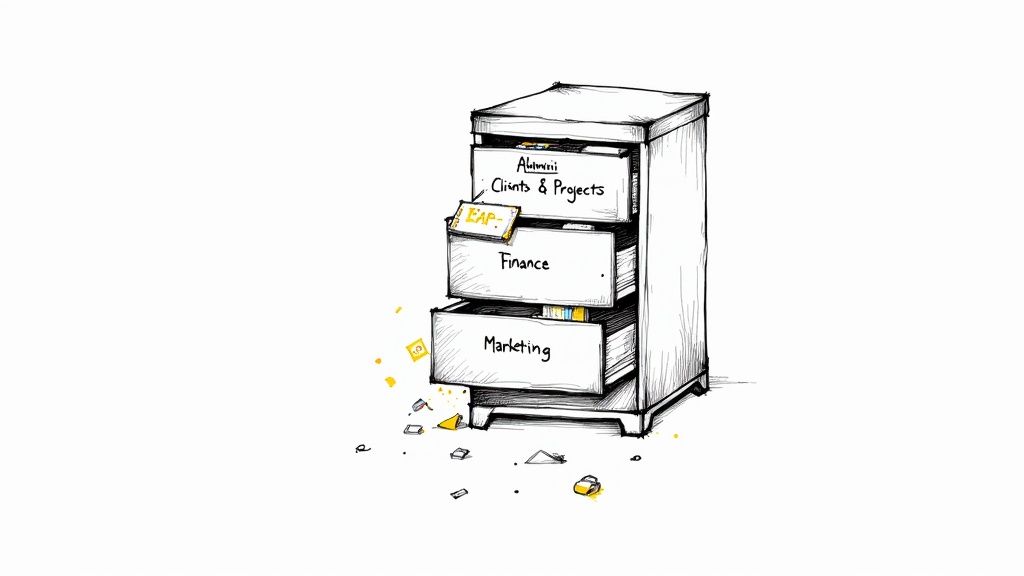

Building Your Digital Filing Cabinet

Alright, this is where the theory ends and we start building something tangible. Creating a solid filing structure for a small business is a lot like framing a house. If you get the main supports right, everything else just falls into place. The result? A system that brings instant clarity and saves you hours of searching.

Forget those complicated, rigid systems that are a nightmare to maintain. We’re aiming for a simple, scalable blueprint you can set up today and easily expand as your business grows. The goal is a digital workspace so intuitive that finding any document becomes second nature.

The Four Pillars of Your Filing System

The best way to start is by creating a handful of high-level folders that cover the core functions of your business. Think of these as your main digital filing cabinets. Every single thing you do, from paying an invoice to onboarding a new client, will have a logical home within one of these four pillars.

Here are the essential master folders every small business should have:

- 01_Admin & Legal: This is for all the official stuff that keeps your business compliant and running smoothly. It’s your company’s official record-keeper.

- 02_Clients & Projects: The heart of your operations. This folder holds all the work you do for your customers, keeping every project neat and accessible.

- 03_Finance: Consider this your financial command center. Every dollar coming in and going out is tracked here, which makes bookkeeping and tax time so much easier.

- 04_Marketing & Sales: This is where you keep all the materials used to attract and win new business, from social media assets to sales proposals.

Did you notice the numbers at the beginning of each folder name? That’s a simple but powerful trick to lock your folders into a fixed, logical order instead of letting them default to alphabetical. It’s a small detail that makes a huge difference in daily use and is a core principle behind many modern filing systems software platforms.

My Two Cents: Start with no more than four to six of these master folders. Keeping the main structure simple makes it easier to remember and stick with, which means you and your team will actually use it consistently.

Drilling Down with Smart Subfolders

Once your main pillars are set, it’s time to add the next layer of detail with subfolders. This is how you bring real order to the chaos. The key is to be specific enough to find things quickly but not so granular that you end up with a confusing maze of empty folders.

Let’s look at how this plays out in the real world with a practical example.

A Simple Filing Structure to Start With

Use this template to create the main categories and essential subfolders for your small business filing system.

| Main Folder | What Goes Inside | Example Subfolders |

|---|---|---|

| 01_Admin & Legal | Official company records, contracts, and compliance documents. | Business Formation, Contracts & Agreements, Insurance Policies, Licenses & Permits |

| 02_Clients & Projects | All files related to specific client work, from proposals to final deliverables. | Client A, Client B, Archived Clients (Inside each client folder: Proposals, Invoices, Project Files) |

| 03_Finance | Invoices, receipts, tax forms, and financial reports. | Invoices Sent, Receipts & Expenses, Bank Statements, Tax Documents (with subfolders for each year, like 2024) |

| 04_Marketing & Sales | Your brand assets, campaign materials, and sales documents. | Brand Kit, Social Media Content, Email Campaigns, Sales Proposals |

This layered approach gives every single document a dedicated home. It eliminates the guesswork and ensures you can pull up anything you need in just a few clicks. Nailing this foundational structure is your first big step toward a more productive and less stressful workflow.

How to Name Your Files for Easy Searching

Even the most brilliant folder structure can be brought to its knees by chaotic file names. Think about it: your folders are the filing cabinets, but your file names are the labels on the manila folders inside. If those labels are vague, inconsistent, or just plain messy, you’re still stuck hunting for what you need. That guesswork kills productivity.

Getting into the habit of using a consistent naming convention is one of the biggest small-wins you can have as a small business. It makes finding any file almost instant, clears up any confusion about which version is the “real” one, and just brings a sense of calm to your workflow. This is a non-negotiable part of a strong filing structure for small business.

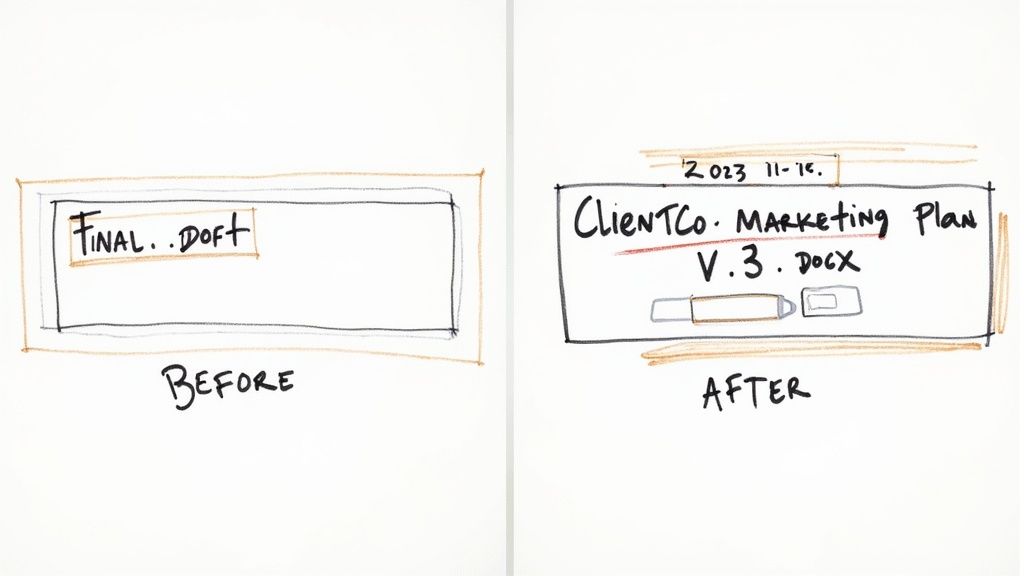

The Anatomy of a Perfect File Name

A great file name should tell you exactly what’s inside without you ever having to open it. The best way to do this is to come up with a simple, repeatable formula that you and your team can stick to. It brings clarity and, even better, makes your files sort themselves chronologically.

Here’s a practical formula that just works: Date_Client/Project_Description_Version

Let’s unpack that with an actionable example.

- Date (YYYY-MM-DD): Always, always start with the date in this format. Why? Because it automatically sorts your files by date, from oldest to newest. No more guessing which file is the most recent.

- Client/Project: Right after the date, add the client’s name or the internal project this file relates to.

- Description: Be specific but keep it brief. What is this thing? Think

Marketing-Plan,Invoice-1045, orBlog-Draft. Pro tip: use hyphens instead of spaces to keep file names web-friendly and easy to read. - Version (v1, v2, v3): This little detail is a lifesaver. Ending with a version number avoids the dreaded nightmare of having three different files all named

FinalDraft.

See the Difference in Action

Let’s imagine you just wrapped up a proposal for a new client, “ClientCo.”

The Old Way:

Final Proposal rev.docxThe New Way:

2024-11-15_ClientCo_Marketing-Proposal_v3.docx

The “old way” is a digital time bomb. It tells you nothing, forcing you to open it to understand its contents—a huge waste of time. The “new way,” on the other hand, is a searchable, informative gem. You instantly know it was created on November 15th, 2024, it’s for ClientCo, it’s a marketing proposal, and you’re looking at the third version. No mystery, just pure productivity.

Staring at a mountain of poorly named files from the past? Don’t panic. You don’t have to fix them all one by one. Our guide on using a batch rename utility can help you reclaim your time and get your existing files in order quickly.

With over 36 million small businesses operating in the U.S., efficiency isn’t just a nice-to-have; it’s how you stay competitive. Small firms are a huge part of the economy, accounting for nearly half of all private-sector jobs. In fact, between March 2023 and March 2024, 1.1 million new businesses created 1.2 million new jobs. Getting your digital house in order with a clear filing system is a simple but powerful step to make sure your business runs smoothly enough to be part of that growth. You can check out more stats on the latest small business trends at Bankrate.com .

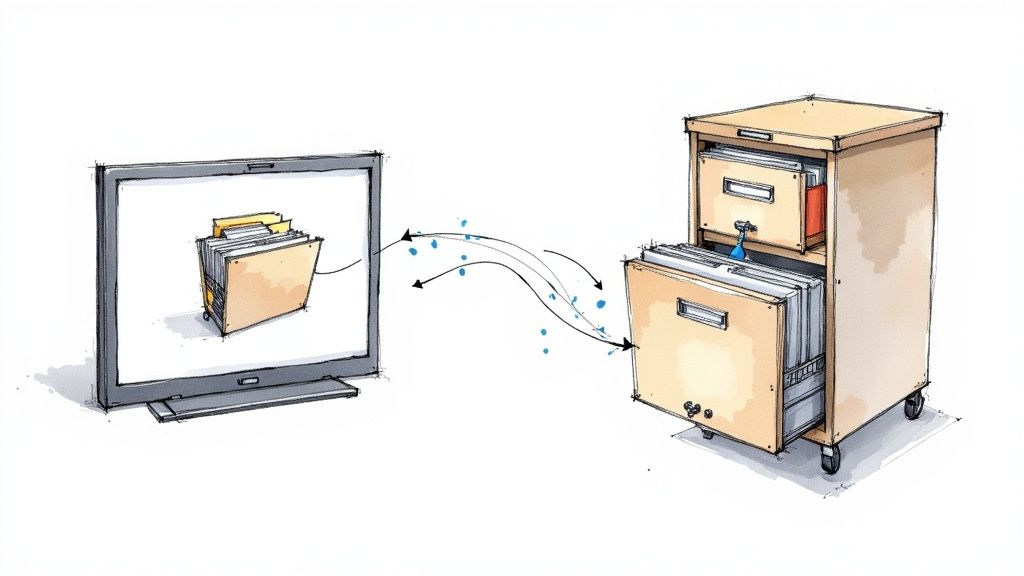

Managing Digital and Physical Documents

Even with the best digital system, most of us are still swimming in a sea of paper. From signed contracts to official licenses, some documents simply demand a physical home. Juggling both digital and physical files can feel like working two separate jobs, but it doesn’t have to be a headache.

The trick is to create a unified strategy. This way, you can find anything in seconds, whether it’s on your screen or tucked away in a filing cabinet.

What to Keep Physical vs. What to Digitize

First things first: you have to decide what truly needs to be kept in hard-copy form. Let’s be honest, not every piece of paper deserves precious office space. Your goal is to shrink that physical footprint without risking compliance or security issues.

Here’s a simple, practical breakdown:

- Keep as Hard Copies: These are your non-negotiables. Think original signed client contracts, property deeds, vehicle titles, business licenses, and tax documents that require a wet signature. If the original version holds legal weight, you keep it.

- Scan and Shred: This is where the vast majority of your paperwork belongs. Vendor invoices, expense receipts, bank statements, client correspondence, and old project notes all fall into this bucket. Once they’re digitized and safely backed up, the physical copies are just clutter.

This approach gives you a clear filing structure for your small business that works in both the real and digital worlds.

Making Your Physical and Digital Files Match

This is the secret sauce. To eliminate any confusion, your physical filing cabinet should be a perfect mirror of your digital folder structure.

If your main digital folders are 01_Admin & Legal, 02_Clients & Projects, and 03_Finance, then your filing cabinet drawers or hanging folders should have the exact same labels. It’s that simple.

Key Takeaway: When you file a physical document, like a new insurance policy, you’ll place it in the “Insurance” folder within the “Admin & Legal” drawer. At the same time, you’ll save the scanned copy in the

01_Admin & Legal > Insurancefolder on your computer. This mirroring tactic makes finding documents effortless.

For digitizing, consistency is everything. You can use a scanner app on your phone or a dedicated desktop scanner to turn paper into searchable PDFs. Pro-tip: for critical documents you need for the long haul, save them as PDF/A (Archival). It’s a format designed to ensure the file will still be readable years down the road.

Getting your documents in order is about more than just being tidy; it’s fundamental to your business’s financial health. While small businesses in the U.S. contribute a massive $13.3 trillion to the private sector, the day-to-day reality is often much tighter. A 2023 survey found that 34% of small business owners earned less than $50,000 annually.

A solid filing system helps you track every dollar, which is absolutely essential for survival and growth. You can discover more insights about small business performance at bizplanr.ai to see the bigger picture.

Keeping Your Filing System Clean and Tidy

You’ve done the hard work and built a fantastic, logical filing system. That’s a huge win! But just like a garden, it needs a little upkeep to prevent digital weeds from taking over.

Without a few simple routines, even the most perfect filing structure for small business can slowly unravel. A couple of proactive habits will protect the time you’ve invested and keep your digital space feeling focused and efficient, giving you lasting peace of mind.

The Power of an Archive Folder

One of the best tricks I’ve learned is to create a dedicated “Archive” folder. This is where you’ll move any files or folders that you’re done with but still need to keep for your records. It’s a game-changer for keeping your active workspace clean and productive.

Think of it like this:

- Finished Client Projects: Once that project is completely wrapped up and the final payment has landed, shift the whole folder into your Archive.

- Old Financial Years: After you close out the books for the year, move those folders (like

2024_Invoicesand2024_Receipts) into anArchive > Financesubfolder. - Past Marketing Campaigns: Old social media assets or ad graphics from a previous campaign? Archive them. This keeps your current marketing folder relevant and uncluttered.

You’re not deleting anything. You’re just moving it out of sight. This simple move makes it so much faster to find what you’re actually working on right now, cutting down on the mental drag of sifting through old stuff.

An uncluttered digital workspace directly translates to an uncluttered mind. By regularly archiving old files, you reduce distractions and make it easier to concentrate on your current priorities, boosting overall productivity.

Set a Simple Cleanup Schedule

To stop clutter from piling up again, put a recurring “Filing Tidy-Up” on your calendar. This doesn’t need to be a massive undertaking. A quick, scheduled check-in is all it takes to keep things running smoothly.

For most small businesses, a quarterly or even a semi-annual review works great. Just block out an hour to:

- Empty your “To File” folder: Get everything in your temporary holding pen properly named and moved to its permanent home.

- Archive what’s done: Move any finished projects or client folders into the Archive.

- Delete duplicates and junk: Do a quick scan of recent folders for redundant files or old versions (

..._v1,..._v2) that you no longer need. Be ruthless and hit delete.

These habits matter just as much for physical documents as they do for digital ones. In fact, creating good practices across the board, like delivering a tidy desk policy to ensure a clean, organised, and clutter-free workspace , can reinforce a culture of organization throughout your business.

Safeguard Your Hard Work with Backups

Finally, let’s talk about protecting all this hard work. No filing system is truly complete without a solid backup plan. Your organized files are a core business asset, and protecting them from hard drive failure, theft, or a stray coffee spill is non-negotiable.

The gold standard here is the 3-2-1 backup rule:

- Keep 3 copies of your data.

- Store them on 2 different types of media (e.g., your computer’s hard drive plus an external drive).

- Keep 1 copy completely off-site (the cloud is perfect for this).

Using a cloud storage service like Google Drive , Dropbox , or OneDrive is the easiest way to handle that off-site copy. Most of these services sync your files automatically, so your backup stays current without you even thinking about it. This simple strategy offers incredible peace of mind, knowing your work is safe no matter what.

Common Questions About Organizing Your Business Files

Even with a solid plan, you’re bound to run into a few tricky spots when setting up your new filing system. That’s completely normal. The real magic happens when you nail down these little details, turning a good system into a great one that actually saves you time and stress.

Let’s walk through some of the most common questions I hear from business owners.

How Deep Should I Go With Subfolders?

This is the classic “how granular should I get?” debate. The honest answer? It’s all about finding a balance. You need enough subfolders to find things easily, but not so many that you’re clicking through a maze of nearly empty folders.

My go-to rule of thumb is this: if a new subfolder is only going to hold fewer than five or ten files, you’ve probably gone too far.

Think about vendor invoices. Instead of creating a separate folder for every single vendor, it’s way more efficient to have one Invoices Received folder. A smart naming system like YYYY-MM-DD_VendorName_Invoice123.pdf will keep everything organized for you.

Should I Be Using Tags or Folders?

Here’s the thing: you don’t have to choose. It’s not an either/or situation. The best systems use both.

Folders are your digital filing cabinet—the core structure that holds everything. Tags, on the other hand, are like super-powered sticky notes that connect related files, no matter where they live.

Let’s say you’re working on a new marketing campaign for “Client A.”

- The contract is filed away in

Clients & Projects > Client A > Contracts. - Your campaign graphics are over in

Marketing & Sales > Social Media Content. - The invoice you sent them is in

Finance > Invoices Sent.

These files are in three different places, but they’re all part of the same project. By tagging each one with #ClientA-FallCampaign, you can instantly pull them all up with a single search. Folders give you the foundation, but tags give you incredible search flexibility.

Is It Really Worth the Effort to Reorganize All My Old Files?

Yes, but please don’t try to do it all at once. The very thought of tackling years of digital chaos is enough to make anyone want to give up. My advice? Take a “fix as you go” approach.

Anytime you need to open an old file, just take an extra 30 seconds. Rename it using your new system and move it to its proper new home. Over a few months, you’ll have naturally cleaned up the files you actually use without ever blocking off a whole weekend for the project.

For everything else? Just create an Archive_Old-Files folder and move the rest in there. Done.

My Advice: Pour your energy into making the new system stick for all new documents starting today. This immediately stops the mess from growing and helps you build good habits. You can tidy up the past a little at a time.

How Do I Handle Important Legal and Tax Documents?

When it comes to the official stuff, you want to be extra careful. Documents for legal and tax purposes, like an IRS Form 5500 for your retirement plan or a Form 3520 for foreign gifts, have strict rules about how long you need to keep them.

- Create a

_DO-NOT-DELETEFolder: Inside your mainAdmin & LegalandFinance > Taxfolders, make a special subfolder for these critical documents. The name itself is a clear warning to you and your team. - Talk to a Pro: Don’t guess. Your accountant or lawyer can give you a definitive list of what to keep and for how long (it’s often seven years or more).

- Scan with Care: When you digitize these papers, save them in the PDF/A format. It’s an archival format designed specifically for long-term preservation.

Staying on top of this isn’t just about being tidy—it’s about compliance. The IRS doesn’t mess around with penalties for missing filings, and having these documents properly organized and easy to find is a huge weight off your shoulders.

Ready to stop wasting time on manual filing and finally achieve digital clarity? Fileo uses AI to automatically name, categorize, and organize your business documents within your existing cloud storage. Drag, drop, and let Fileo handle the rest, so you can focus on what truly matters—growing your business. Learn more and start your journey to an organized digital life at fileo.io .